Introduction to profitable intraday trading advice 66unblockedgames.com

Are you looking to boost your intraday profitable intraday trading advice 66unblockedgames.com trading skills and turn consistent profits? Intraday trading is one of the most dynamic and challenging forms of trading, requiring both skill and strategy. If you’ve been struggling to break through or are just starting out, you’re in the right place. In this guide, we’ll share expert advice to help you become a more profitable intraday trader while balancing the challenges of this fast-paced environment. Let’s dive into the strategies that can take your trading game to the next level!

Understanding the Basics of Intraday Trading

What Is Intraday Trading?

Intraday trading, often referred to profitable intraday trading advice 66unblockedgames.com as day trading, involves buying and selling financial instruments within the same trading day. Unlike long-term investing, the goal is to capitalize on short-term price movements to lock in profits before the market closes.

For beginners, the appeal lies in the potential for quick gains. However, without understanding the fundamental aspects, it’s easy to incur losses. A solid grasp of market fundamentals, technical indicators, and risk management is essential to profitable intraday trading advice 66unblockedgames.com stay ahead of the curve.

The Importance of Market Timing

Timing is everything in intraday trading. The best trades often occur within specific timeframes:

Market Open (First Hour) Volatility is high as investors react to overnight news and market developments. This presents lucrative opportunities but also carries significant risks Midday Lull Typically, the market stabilizes during midday, with reduced volatility. This is a time to reassess and refine your strategy for the afternoon Market Close (Final Hour) The profitable intraday trading advice 66unblockedgames.com ast hour often sees a surge in activity as traders close positions. This period is ideal for spotting clear trends.

By understanding these timeframes, you can plan your trades for maximum profitability.

Essential Tools for Intraday Trading

Trading Platform Ensure your trading platform is reliable, fast, and equipped with advanced charting tools Technical Indicators Familiarize profitable intraday trading advice 66unblockedgames.com yourself with moving averages, Bollinger Bands, and Relative Strength Index (RSI) News Feeds Real-time news updates can significantly impact stock prices. Stay updated to anticipate price movements.

Mastering these basics will give you a solid foundation for the strategies we’ll discuss next.

Key Strategies for Profitable Intraday Trading

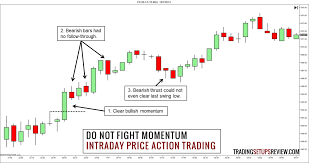

Follow the Trend

One of the simplest yet most effective strategies is to trade with the market’s prevailing trend. The idea is to avoid going against the flow, which can lead to unnecessary losses.

How to Identify Trends:

- Use tools like moving averages to identify trends. For instance, if the price is consistently above the 50-day moving average, the stock is in an uptrend.

- Confirm trends with additional indicators like RSI or MACD (Moving Average Convergence Divergence).

When to Enter and Exit:

- Entry Point: Enter trades when there is a strong confirmation of the trend.

- Exit Point: Exit as soon as you see signs of reversal or when your profit target is reached.

By sticking to the trend, you reduce the likelihood of making emotional, impulsive decisions.

Scalping for Quick Gains

Scalping is an intraday trading strategy that involves making numerous trades throughout the day to capitalize on small price movements. profitable intraday trading advice 66unblockedgames.com While it requires a keen eye and discipline, it can be highly lucrative.

Tips for Scalping:

- Focus on highly liquid stocks with tight spreads.

- Use 1-minute or 5-minute charts to spot entry and exit points.

- Set tight stop losses to minimize risks.

Scalping is not for everyone, but if you have the patience and focus, it can add a consistent stream of income to your trading efforts.

Range Trading

Range trading involves identifying profitable intraday trading advice 66unblockedgames.com stocks that are trading within a defined range and buying at support levels while selling at resistance levels. This strategy works best in sideways markets.

Steps to Range Trade Successfully:

- Identify support and resistance levels using technical analysis.

- Place buy orders near support and sell orders near resistance.

- Use a stop-loss slightly outside the range to manage risk.

This strategy is particularly useful when the market lacks a clear direction, allowing you to profit from small but predictable movements.

Risk Management: The Key to Longevity in Trading

Why Risk Management Is Crucial

Even the best trading strategies can profitable intraday trading advice 66unblockedgames.com fail without proper risk management. The primary goal in intraday trading is to protect your capital and live to trade another day.

Implementing Stop-Loss Orders

A stop-loss order is a predefined price at which your trade will automatically close to prevent further losses. This tool is indispensable for intraday traders.

- Rule of Thumb: Never risk more than 1-2% of your capital on a single trade.

- Example: If your trading account has $10,000, your maximum loss on any trade should not exceed $200.

By adhering to strict stop-loss rules, profitable intraday trading advice 66unblockedgames.com you’ll minimize your exposure to unexpected market swings.

Diversify Your Trades

Avoid putting all your eggs in one basket. Spread your trades across different sectors or assets to reduce the impact of a single loss.

Keep Emotions in Check

Trading can be stressful, especially during volatile periods. To avoid making emotional decisions:

- Stick to your predefined trading plan.

- Take breaks if you feel overwhelmed.

- Celebrate small wins to stay motivated.

Psychological Aspects of Intraday Trading

Staying Disciplined

Discipline is the backbone of successful trading. Without it, even the most effective strategies will fail. Here’s how to maintain discipline:

- Create a trading journal to track your progress.

- Review your trades daily to identify patterns and mistakes.

- Avoid revenge trading after a loss.

Dealing with Losses

Losses are inevitable in trading, but profitable intraday trading advice 66unblockedgames.com how you handle them can make or break your success. Accept losses as part of the learning curve and focus on improving your strategy.

Continuous Learning

The financial markets are constantly evolving. To stay ahead:

- Follow market news and trends.

- Invest in courses or webinars to refine your skills.

- Join trading communities to exchange insights with peers.

Advanced Tips for Maximizing Intraday Profits

Leverage Technology

- Use algorithmic trading to execute trades faster and more accurately.

- Employ screeners to filter stocks that match your criteria.

- Explore trading bots for repetitive tasks.

Focus on High-Volume Stocks

High-volume stocks offer better liquidity and tighter spreads, making them ideal for intraday trading. Keep an eye on the day’s top gainers and losers to find opportunities.

Monitor Your Performance Metrics

Track your win rate, risk-reward profitable intraday trading advice 66unblockedgames.com ratio, and average holding time to identify areas for improvement. Use tools like Excel or specialized trading journals to analyze your performance.

Conclusion:

Intraday trading can be both thrilling and rewarding, but it requires a strategic approach, discipline, and continuous learning. By following the advice outlined in this guide, you can increase your chances of success and turn intraday trading into a profitable venture.

Whether you’re a beginner or an experienced trader, always prioritize risk management and stay updated with market trends. With the right mindset and tools, the world of intraday trading offers endless opportunities for growth and financial independence.